If you had invested in internet companies in the late 1990s, you’d remember two things clearly: the incredible upside—and the brutal mistakes. Some names became trillion-dollar giants. Others vanished entirely.

That’s exactly where stock in AI sits today.

Artificial intelligence is not a trend, a buzzword, or a speculative toy anymore. It’s quietly becoming the operating system of modern business. And investors—smart ones—are no longer asking if AI will reshape markets, but which stocks will actually capture the value.

This guide is written for people who want to invest intelligently, not emotionally. Whether you’re new to AI investing or already holding positions, this article walks you through how AI stocks really work, how professionals evaluate them, and how to avoid the traps that wipe out most retail investors.

You’ll leave with:

- A clear mental model of what “stock in AI” actually means

- Practical frameworks for picking quality AI stocks

- Real-world examples across sectors

- Tools, comparisons, and expert-level decision logic

No hype. No empty predictions. Just experience-backed clarity.

Stock in AI Explained: From Buzzword to Business Reality

When people hear stock in AI, they often imagine humanoid robots or sci-fi futures. That misunderstanding alone causes most investment mistakes.

At its core, stock in AI refers to publicly traded companies whose revenue growth, competitive advantage, or future value is materially driven by artificial intelligence—not companies that merely mention AI in earnings calls.

Think of AI as electricity in the early 20th century. It wasn’t a product—it was an enabling force. Companies that learned how to use electricity efficiently dominated. Others fell behind.

AI works the same way.

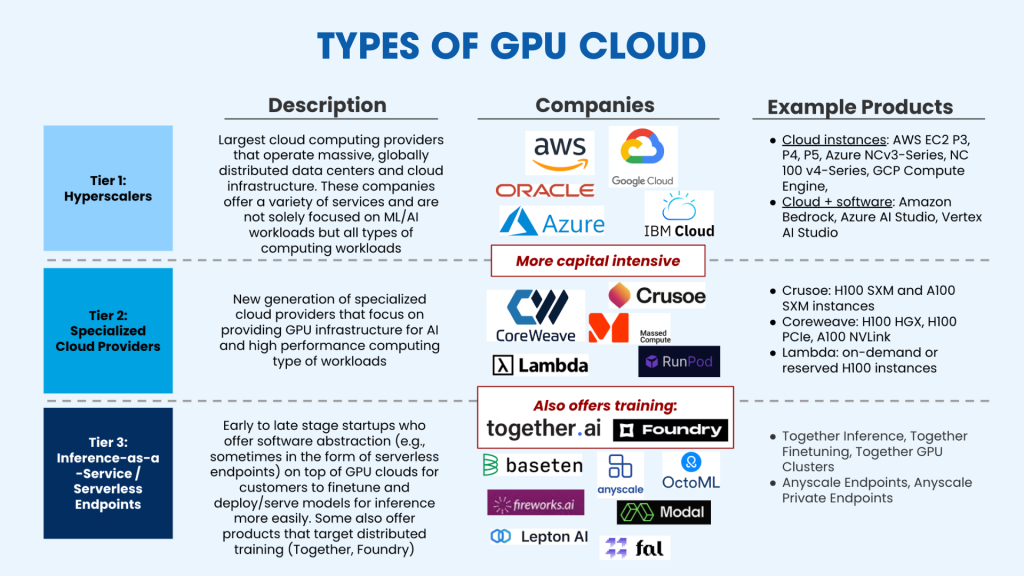

There are three fundamental layers to AI stocks:

First, infrastructure providers. These are the companies building the computational backbone—chips, cloud platforms, data centers. Without them, AI doesn’t run.

Second, AI model and platform companies. These firms develop foundational models, machine learning platforms, and developer ecosystems.

Third, AI-enabled businesses. These are companies using AI to radically improve margins, scale faster, or disrupt incumbents.

A crucial insight most beginners miss:

The best AI stock isn’t always the one building AI—it’s often the one using AI better than competitors.

This is why understanding how AI creates economic value matters more than knowing technical jargon.

Why Stock in AI Matters Right Now (Not Five Years Ago)

AI has existed for decades. What changed recently isn’t intelligence—it’s economics.

Three forces converged:

- Computing power became scalable and affordable

- Massive datasets became accessible

- Models became commercially useful, not just academic

This combination flipped AI from “R&D expense” to “profit engine.”

Businesses now deploy AI to:

- Reduce labor costs

- Increase pricing power

- Personalize products at scale

- Predict demand and optimize logistics

- Automate decision-making

From an investor’s perspective, this means AI is now visible in:

- Earnings growth

- Margin expansion

- Competitive moats

- Long-term guidance

Markets reward measurable impact, not promises.

That’s why stock in AI has moved from speculative to structural—and why timing matters now more than ever.

The Core Benefits of Investing in Stock in AI (With Real Use Cases)

Let’s move from theory to tangible outcomes.

Revenue Acceleration

AI-driven companies often scale faster without proportional cost increases. Software firms using AI can onboard thousands of clients without hiring thousands of employees.

Margin Expansion

Automation reduces human bottlenecks. Predictive analytics reduce waste. Personalized pricing improves profitability.

Competitive Moats

Once a company trains AI on proprietary data, competitors can’t replicate it easily. Data + models compound over time.

Industry Disruption

Entire sectors—from healthcare to logistics—are being restructured around intelligent automation.

For example:

- Retailers use AI for inventory forecasting and dynamic pricing

- Financial institutions deploy AI for fraud detection and risk modeling

- Manufacturers use AI-driven robotics for precision and uptime

The “before vs after” difference is often night and day. Investors who recognize that early capture disproportionate gains.

Types of Stock in AI You Can Invest In (And How to Think About Each)

1. AI Infrastructure Stocks

These companies sell the picks and shovels of the AI revolution.

A prime example is NVIDIA, whose GPUs power most large-scale AI workloads. When AI adoption increases, demand for compute follows.

Pros:

- High demand visibility

- Industry-wide exposure

Cons:

- Valuation sensitivity

- Cyclical capital spending

2. AI Platform & Software Companies

These firms build AI tools, APIs, and platforms that businesses integrate directly.

Companies like Microsoft embed AI across cloud services, productivity tools, and enterprise software—creating multiple monetization channels.

Pros:

- Recurring revenue

- Strong customer lock-in

Cons:

- Slower growth than pure infrastructure plays

3. AI-First Application Companies

These businesses wouldn’t exist without AI. Their product is intelligence.

Think automated trading systems, diagnostics platforms, or autonomous logistics software.

Pros:

- Explosive upside

- Category leadership potential

Cons:

- Higher failure rates

- Execution risk

4. AI-Enabled Traditional Companies

Often overlooked—and often undervalued.

A retailer using AI to optimize supply chains may quietly outperform peers for years without flashy headlines.

Step-by-Step: How to Evaluate a Stock in AI Like a Professional

Step 1: Identify Where AI Sits in the Business Model

Ask one question:

If AI disappeared tomorrow, would this company still have an edge?

If yes, AI is a bonus.

If no, AI is core—and riskier.

Step 2: Follow the Revenue, Not the Narrative

Look for:

- AI-related revenue breakdowns

- Margin changes over time

- Customer adoption metrics

Ignore vague phrases like “AI-powered solutions” without numbers.

Step 3: Assess Data Advantage

The best AI companies own:

- Proprietary datasets

- User behavior loops

- Industry-specific data

Without data, AI models commoditize quickly.

Step 4: Examine Capital Intensity

AI infrastructure is expensive. Companies burning cash without a path to profitability should raise caution.

Step 5: Compare Valuation to Growth Quality

High multiples are acceptable only when growth is durable and defensible.

Tools, Platforms, and Expert Recommendations for AI Stock Research

Best Free Tools

- Yahoo Finance: Financials, historical data

- Seeking Alpha: Earnings call insights

- Google Patents: Innovation tracking

Professional-Grade Platforms

- Morningstar: Moat analysis

- Bloomberg (institutional): Deep AI exposure mapping

My Expert Take

Use free tools for screening, then go deep on business fundamentals, not AI headlines. The best investors read transcripts, not Twitter threads.

Common Mistakes Investors Make With Stock in AI (And How to Avoid Them)

Mistake 1: Chasing Hype Cycles

AI headlines spike prices short-term. Fundamentals decide long-term.

Fix: Buy during consolidation, not euphoria.

Mistake 2: Overpaying for “Pure AI”

Pure-play AI companies often trade on dreams, not cash flows.

Fix: Balance portfolios with infrastructure and AI-enabled incumbents.

Mistake 3: Ignoring Regulation & Ethics

AI regulation affects margins and deployment speed.

Fix: Favor companies actively engaging regulators, not avoiding them.

Mistake 4: Lack of Time Horizon

AI adoption compounds over years, not quarters.

Fix: Invest with 3–10 year conviction, not weekly charts.

The Future Outlook for Stock in AI: What Comes Next

AI is shifting from experimentation to standardization. The next phase rewards:

- Companies integrating AI deeply into operations

- Firms monetizing AI quietly, not loudly

- Businesses building ecosystems, not one-off tools

Expect:

- More AI regulation

- Margin differentiation across industries

- Consolidation among weaker AI startups

The biggest winners won’t always be obvious—but they’ll show up consistently in earnings.

Conclusion: Investing in Stock in AI With Confidence, Not Guesswork

Stock in AI isn’t about predicting the future—it’s about understanding where intelligence creates economic leverage today.

The investors who win won’t be the loudest or fastest. They’ll be the most disciplined, patient, and selective.

Start with businesses, not buzzwords.

Follow cash flows, not headlines.

And remember: AI is a tool—great companies turn tools into profit.

If you approach AI investing with clarity instead of hype, you won’t just participate in the future—you’ll compound alongside it.

FAQs

Is stock in AI risky?

Yes—but risk varies widely by company maturity and valuation.

Are AI stocks overvalued right now?

Some are. Others remain undervalued due to poor market understanding.

Can beginners invest in AI stocks?

Absolutely—starting with diversified, AI-enabled large caps.

What’s the safest way to gain AI exposure?

Broad tech leaders and infrastructure providers.

Will AI replace jobs and hurt companies?

AI replaces tasks, not companies that adapt early.

There’s a certain weight in the words John Authers writes—not just because of what he knows, but how he shares it. His voice doesn’t just echo facts; it builds meaning. In a world overwhelmed by rushed opinions and robotic summaries, John’s writing feels… different. It feels lived-in, thoughtful, and deeply human.

Readers don’t turn to John for headlines—they come for context. They come for that rare blend of clarity, insight, and emotional depth that turns financial journalism into something closer to storytelling. His reflections on markets, geopolitics, or human behavior aren’t just readable—they’re relatable.

What sets John apart isn’t just his experience (though he has plenty of it). It’s his ability to pause, reflect, and explain the why behind the what. He writes like someone who’s been in the room where it happens—but never forgets the reader who hasn’t.

In 2025, when AI churns out articles in milliseconds, John Authers still writes like a human—and that, more than anything, is what makes his work worth reading.